Company :Sara lee

Agency : Grey worldwide

Kiwi is the challenger brand in the Rs 60 crore shoe care market in India. Kiwi was an active player in the shoe care market from 1994 onwards. The brand is owned by $18 billion Sara Lee corporation. In India, Sara Lee started as a joint venture with TTK corporation. In 2002, it became an independent venture. Now SaraLee has tied up with Godrej to market its products.

The

shoe care market in India is small. This market was dominated by Cherry Blossom from Reckitt and Benckiser which earlier had a market share of 80%. Kiwi was the challenger brand and right now it holds a market share of 40 % and Cherry's market share decline to around 50%.

shoe care market in India is small. This market was dominated by Cherry Blossom from Reckitt and Benckiser which earlier had a market share of 80%. Kiwi was the challenger brand and right now it holds a market share of 40 % and Cherry's market share decline to around 50%. Shoe

polishes are infrequently purchased products with very less involvement from the customer. Cherry Blossom had a generic brand status in the market. Wax polishes constitutes 70% of the market while liquid polish constitutes 20%.

polishes are infrequently purchased products with very less involvement from the customer. Cherry Blossom had a generic brand status in the market. Wax polishes constitutes 70% of the market while liquid polish constitutes 20%.In order to displace the leader, Kiwi banked on Innovation strategy which the market leader failed to anticipate .

Kiwi was the first one to bring International standard Liquid shoe polish in India .It also pioneered the Shoe shine sponge which was a blockbuster. Kiwi was also the first brand to launch Suede and Nubuck range.

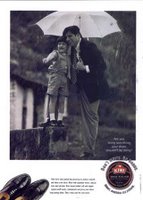

These new product launches and careful campaigns helped Kiwi to have a top of the mind recall for the

brand. As in the case of Robin Liquid, which failed to respond to Ujala's challenge, Cherry Blossom also failed to respond. While Kiwi talked about quality shoe care, Cherry Blossom was stuck with Poor " Charlie Chaplin look alike " ads.

brand. As in the case of Robin Liquid, which failed to respond to Ujala's challenge, Cherry Blossom also failed to respond. While Kiwi talked about quality shoe care, Cherry Blossom was stuck with Poor " Charlie Chaplin look alike " ads.Most of the new product launches of Kiwi was in line with the changing consumer preferences. When the consumers opted for semi casual Suede and nubuck shoes, Kiwi was quick to launch Shoe care products for that category.

Today in this hectic rush , seldom do we get time to polish our shoe

s every day. Understanding this Consumer insight, Kiwi launched Express shoe polish which can be used to shine shoes when you are in a rush. These innovations surely helped the brand to create a market for itself.

s every day. Understanding this Consumer insight, Kiwi launched Express shoe polish which can be used to shine shoes when you are in a rush. These innovations surely helped the brand to create a market for itself. The Shoe care market has all the potential to grow since the shoe market is growing ( Derived Demand ?)

Kiwi is a good example of how innovations can help in challenging a market leader.