Company: N Rangarao and Sons

The Indian Agarbatti market is worth around 1000 crores and is dominated by the unorganised sector.Hardly 15% of this market

is branded. This market is unattractive because of high labour cost and lack of possibilities of differentiation and price sensitivity.

is branded. This market is unattractive because of high labour cost and lack of possibilities of differentiation and price sensitivity.Cycle brand is owned by Bangalore based N Rangarao and sons. NRS were pioneers in branding this difficult market and C

ycle brand is one of the largest agarbatti brand in India which have a market share of 8%.

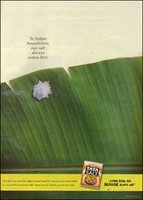

ycle brand is one of the largest agarbatti brand in India which have a market share of 8%.Cycle brand was launched in 1948. In this commodity market,Cycle was positioned as a premium agarbatti brand. The brand was trying to differentiate by good packaging, marketing campaigns and quality. Cycle 3-in -one is the most popular which have three different fragrance sets of agarbattis in one pack.

Agarbattis are low involvement products whose purchases are often impulsive. Since there are a few brands in this category, customers makes purchase based on impressive packaging, fragrance or price. Since the price is less, there is little scope for brand loyalty.

Cycle brand has established itself in the market with some good marketing campaigns with emphasis on quality and fragrance. Recently NR sons have launched a new brand Lia with trendy packaging and good advertising.

The market is going to witness some serious marketing action with the entry of ITC. ITC is planning to make this a lifestyle product. ITC is launching a premium brand "Sphriha" which is manufacture d by Aurobindo Ashram, Pondicherry. ITC is also launching different brand in various segment viz Nivedan in the mid segment, Ashageet in the lower segment. With lot of cash for marketing, ITC will be a serious threat to Cycle.

d by Aurobindo Ashram, Pondicherry. ITC is also launching different brand in various segment viz Nivedan in the mid segment, Ashageet in the lower segment. With lot of cash for marketing, ITC will be a serious threat to Cycle.

d by Aurobindo Ashram, Pondicherry. ITC is also launching different brand in various segment viz Nivedan in the mid segment, Ashageet in the lower segment. With lot of cash for marketing, ITC will be a serious threat to Cycle.

d by Aurobindo Ashram, Pondicherry. ITC is also launching different brand in various segment viz Nivedan in the mid segment, Ashageet in the lower segment. With lot of cash for marketing, ITC will be a serious threat to Cycle. The entry of ITC can be a positive factor also since the marketing effort will expand the market and thus Cycle brand will also benefit.

Agarbatti market is a very difficult market to crack because agarbatti is limited to pooja rooms only and there is a religious aspect to the product. The marketers have to take some lessons from "Nightingale" brand ( discussed in my previous blogs) to make an impact. The product have some inherent disadvantage like the residual ash and short burning time. Marketers have to take this brand out of pooja rooms. Theme based marketing can also be tried. Ash-less agarbattis can be an innovation worth thinking provided that attribute is considered important by the consumers. Healthy fumes can be used as a strategy to attack the lower priced incense sticks warning the consumers of health hazard of using unbranded agarbattis.

This market is worth watching for because it is a challenge for marketers to establish a value proposition in a commodity market.